Global Outlook 2018

This article is from our latest edition of MarketWatch, an in-depth report focusing on the Global Economic Outlook for 2018.

25th January, 2018

Global economic forecasts point to a broader growth picture emerging in 2018. All major regions are contributing to the positive momentum, with the latest data pointing to a synchronised recovery in the three main pillars of the global economy: the US, Europe and China.

At its October meeting in Washington, the International Monetary Fund (IMF) acknowledged this more positive outlook by raising its global economic growth forecast to 3.7% for 2018, up from 3.4% in 2017. Although global growth is not expected to reach the lofty levels of 5-6% generated in the last cycle, this is an important milestone. For far too long the recovery was overly reliant on the US, but now other major economies are contributing, most notably Europe.

Central banks’ strategies, including zero interest rates and quantitative easing (QE), have been key to the recovery. But as the economic outlook improves they are slowly starting to remove these stimuli.

Inflation has been particularly elusive over this cycle, but a tighter labour market will eventually lead to demands for higher wages. This should translate into higher inflation and interest rates could rise faster than expected in such a scenario. Whether 2018 proves to be the year remains to be seen, but the consensus view is that there is a risk of higher inflation over the next 12 months.

The most obvious macro risk is a miscalculation or misstep by central banks. We expect the normalisation of interest rate policy to be very gradual. The US Federal Reserve (Fed) is expected to announce three rate hikes in 2018, and while the European Central Bank (ECB) is not expected to raise rates until 2019, it is scaling back on its bond buying QE programme.

But there are a number of other risks. Global debt levels remain high. Low interest rates and low market volatility have encouraged risk taking and equity and bond valuations are increasingly looking elevated. There are also a number of geopolitical risks that will test nerves: Brexit, North Korea, Catalonia and the Italian elections.

However, the lesson from recent years is that while all these issues can create turbulence in the short term, ultimately the market takes its direction from the fundamentals of the global economic and business cycle.

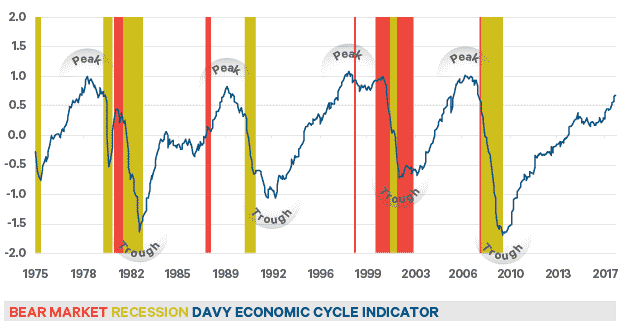

Our US cycle indicator (UCI) tells us that we are moving into the later stage of the current cycle (see Figure 1). Having hit a soft patch in 2015-2016, the cycle is accelerating due to the flattening bond yield curve, improved corporate profitability and rising confidence indicators.

Given that many economists’ forecast we will see a pick-up in global growth again this year, it is difficult to see a recession in the next 12 months, and our own indicator suggests we are not yet at a point where conditions are overheating. As a reference point, conditions today are consistent with those in 1997 and 2005. This suggests there are a few years left to go, but the later we are in the cycle the less room there is for error. We think it is prudent to ensure that investors are sufficiently diversified and consider building in some downside protection in their portfolio as the cycle progresses.

Our base case is that there is a one in five chance of a downturn next year. But we think it is more likely that conditions will start to overheat and the global economy will contract over a 2-3 year time horizon.

Source: Bloomberg

Although the US economy stuttered at the beginning of last year, it has regained momentum. Gross domestic product (GDP) growth reached 3.3% in the third quarter and 2017 was the first year since 2012 that growth has beaten expectations.

This momentum looks set to continue into 2018. The strength of the US labour market is particularly positive - unemployment is at its lowest level in 16 years and there are over 6 million open job positions.

In Washington, Trump’s cuts to both corporate and consumer tax rates is expected to push growth higher. Such a move could push GDP growth above 3%, with obvious positive knock-on effects for corporate earnings.

However, a growing number of economists are highlighting that this cycle is already one of the longest on record. The post- financial crisis recovery that began in 2009 is now in its 102nd month of expansion. This is the third longest in the post-war era, only bettered by the 120-month expansion that took place in the 1990s and a 106-month expansion in the 1960s.

If the Trump administration manages to deliver on its fiscal expansion agenda, including tax cuts and infrastructure spending, it would boost economic momentum. However, it will probably come at the cost of an increased debt burden.

The major downside risk, given tight labour market conditions, is if inflation starts to accelerate as a result of the looser fiscal stance and the Fed needs to hike interest rates at a quicker pace than anticipated. New Fed chair, Jerome Powell, has indicated that any further removal of stimulus is likely to be gradual. But any substantial pick-up in inflation may require rates to be increased quicker than expected.

Overall the IMF expect the US economy to grow by 2.3% in 2018.

Europe was the surprise of 2017. Once the sick man of the global economy, conditions have started to improve. Although Angela Merkel is still struggling to form a coalition in Germany and tensions between Catalonia and Spain persist, the underlying trend in the Eurozone is positive and the best it has been since before the 2011 debt crisis.

In Germany, the region’s largest economy, unemployment is at the lowest level since the fall of the Berlin Wall. Even troubled nations like Spain and Italy are showing signs of life. Italian elections this year could test investors’ nerve, with the anti- establishment Five Star Movement doing well in the polls.

On several metrics Europe is growing as fast as the US, albeit from a weaker starting position. This is because fiscal and monetary policy is no longer a drag on the broader economy.

One concern is that the improved economic momentum has translated into a stronger euro. Having weakened considerably in recent years, last year the euro appreciated 14% against the US dollar. Europe is relevant on export growth to sustain its recovery and a stronger euro could hit exports.

As Mario Draghi begins his final full year as ECB president, Europe is on much firmer footing than at the start of his presidency in 2012. The ECB is confident in the growth outlook so it is tapering its bond buying QE programme, and economists are forecasting that the first rate hike will take place in 2019.

The IMF forecast that the Eurozone will grow at a pace of 1.9% in 2018.

The full impact of Brexit has yet to be felt by the British economy. In fact, since Article 50 was triggered in March, the economy does not look to have deteriorated at all. Unemployment fell to a 40-year low in 2017 and UK manufacturing and exports are benefiting from sterling’s weakness. But that doesn’t tell the full story.

So far the only major effect of Brexit has been the devaluation of sterling, which has led to higher inflation, falling real wages, and the weakening of the housing market.

The UK economy’s performance will be heavily influenced by how the exit negotiations progress. The EU now seems to be firmly in the driving seat and the weak position of the Tory government means that the UK may have to accept a “status quo” transition deal. There is also the potential of another general election which could open the door for a Labour- led government. Continued uncertainty could cause a deeper slowdown in 2018 if business and consumer sentiment deteriorates and spending is reined in.

Overall we forecast that the UK economy will expand by just 1.2% in 2018, but the risk of a bad Brexit is high so this may be reduced significantly.

The rapid build up of debt in China has raised concerns that the world’s second largest economy is at risk of a hard landing. The Chinese authorities have done a good job re-orientating the economy from export growth to domestic consumption.

As noted in the IMF report last year "economic activity surprised on the upside despite tighter financial conditions stemming from policies to contain financial stability risks, especially in the shadow banking and real estate sectors". The economy is expected to have expanded by 6.8% in 2017.

The government has been putting tighter controls on bank lending and local government’s borrowing activities to try and ensure that parts of the economy do not overheat. This was emphasised at the Communist Party of China’s meeting in October, where the emphasis was on the quality of growth rather than quantity. The party is also placing a greater emphasis on sustainability and reducing inequality.

When it next meets, the Central Economic Working Conference is expected to reaffirm a growth target of 6-7%. The major challenge is striking a delicate balance between addressing key risks, such as the expansion of credit, and broad policy support needed for stable growth.

One area the authorities have been keen not to allow get out of control is the housing market. Prices increased rapidly between 2015 and 2016 - prices in major cities such as Beijing and Shanghai rose by 30%. Since then, mainly due to government cooling measures to curb speculation in bricks and mortar, the housing market has slowed considerably.

Against a backdrop of an accelerating global economy the IMF expect China to grow by 6.5% in 2018.

This article is from our latest edition of MarketWatch, an in-depth report focusing on the Global Economic Outlook for 2018.