Outlook 2017: New World Order

This article is from our Global Outlook for 2017 which takes a look back at key political and economic milestones for 2016.

01st January, 2017

The euro finds itself caught between a stronger dollar and a weaker pound. How it performs in 2017 will depend on a number of factors including political uncertainty around the French, Dutch and German elections and the ongoing negotiations regarding the UK's exit from the EU.

The euro could find itself under a cloud of political uncertainty for much of 2017. As Brexit and the recent Italian referendum highlighted, questions still persist about whether the Eurozone will survive as a union and these may intensify in the next few months.

The French, Dutch and German election results will play a large role in determining which way the euro moves. If the electorate supports more pro-European candidates, like François Fillon in France and Angela Merkel in Germany, we could see the euro rise above $1.10. However, if not the euro could test parity against the dollar and in the worst-case scenario, fall even further.

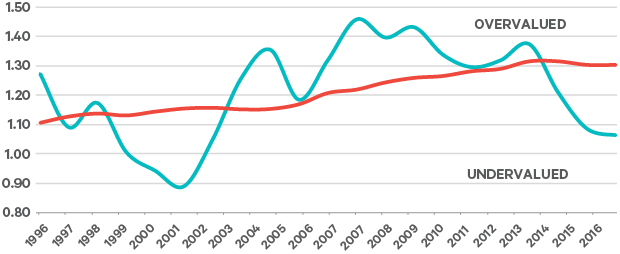

Investors need to be conscious that at current levels, the euro is already about 20% undervalued. The dollar has been gradually gaining strength for years and is now 40% above its 2011 lows. Based on the Organisation for Economic Co-operation and Development (OECD) measure of purchasing power parity (PPP), fair value is closer to 1.30 as shown in Figure 1. This could put a floor on how much further the euro can depreciate.

Another issue for investors to consider is diverging central bank policy. The Federal Reserve has just undertaken its second rate hike and the market is expecting two more in 2017. In contrast, the European Central Bank (ECB) has indicated it will extend its Quantitative Easing (QE) programme until the end of the year. In theory this should strengthen the dollar further, but any sign of the ECB ending QE could result in a sharp reversal of the recent weaker euro trend.

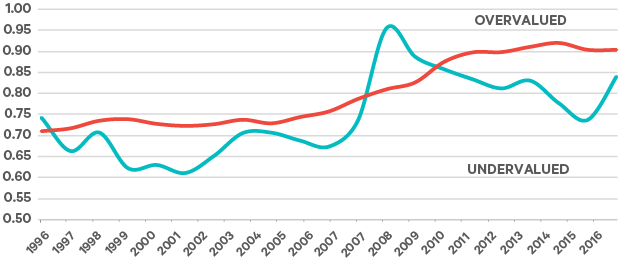

The direction of sterling is also dependent on political events, in particular the negotiations to leave the EU once Article 50 is triggered. Our view is that a hard Brexit is almost inevitable. Britain simply cannot detangle itself from 30 years of integration in Europe in the two-year timeframe. The prospect of an unruly exit that could disrupt trade and growth could once again lead to bouts of weakness in sterling as negotiations progress.

Figure 1: EUR/USD & PPP

Source: Bloomberg, OECD

Figure 2: EUR/GBP & PP

Source: Bloomberg, OECD

This article is from our Global Outlook for 2017 which takes a look back at key political and economic milestones for 2016.

Past performance is not a reliable guide to future performance. The value of investments and of any income derived from them may go down as well as up. You may not get back all of your original investment. Returns on investments may increase or decrease as a result of currency fluctuations.